Every industry in the world is implementing AI to speed up their processes and the crypto marketplace is not an exception at all. AI Agents in crypto are self-operating software programs that provide real-time insights and predict the pricing movements to take an informed decision. Further, they detect any odd activity and prevent users from cyberattacks and scams.

Crypto AI Agents are changing the crypto market forever through portfolio management, DeFi optimization, and NFT automation. These highly advanced agents allow users to tap into every possible money-making opportunity in the crypto market. Read this blog to learn what are AI Agents in crypto, their benefits, challenges and future.

What are AI Agents in Crypto?

Crypto AI Agents are independent software applications that work on blockchain networks. They work as your personal virtual assistants and can execute actions like swaps or notes. This means that you don’t have to keep an eye on the market all the time.

If you are a beginner and don’t know how to trade in the crypto market, analyse market trends or predict pricing, a crypto AI agent will do everything for you. You can even set instructions and the AI agent will follow it without fail.

Example – Let’s say you have already bought 10000 bitcoins and its current price is $30000. You can set the instructions to buy more shares when the price will go below $25000 and sell the shares if it goes beyond $35000.

Not just the automation but Crypto AI Agents also come with enhanced security features. It can detect any kind of odd activity in your cryptocurrency account and prevent any mishappening.

AI Agents Vs Chatbots

Many people get confused between AI Agents and chatbots. While AI Agents are powerful software programs that can take independent decisions on behalf of users, chatbots are merely softwares which answers users’ queries.

A chatbot guides you to do a particular action, but at the end only you have to do the work. On the other hand, crypto AI Agents require very little human input and do all the work on their own.

A chatbot gives scripted answers for a pre-defined set of questions, while an AI agent uses natural language processing and goes in-depth to answer based on real-time data.

Example –

- Chatbot: You can ask a chatbot “what is the current price of Ethereum?”. The chatbot using its previous knowledge base will answer the price of Ethereum.

- AI Agent: For a chatbot you can set a goal like “Grow my portfolio by 20% this month with low risk”. Now the agent will track real-time market data and find the best opportunities aligning with your goal. Based on the analysis it will decide when to buy or sell the crypto assets.

Key Benefits of AI Agents in Crypto

AI Agents work 24*7, provide real-time insights, and execute blockchain transactions at a lightning speed. They not only predict market trends accurately, but also safeguard investors from scams and risk. Given below are some benefits of AI Agents in crypto:

-

Improved Efficiency and Faster Speed

Crypto AI Agents can execute transactions faster than any human. The prices in the crypto market change every second and the quick decision-making speed of AI Agents can help users make substantial profit. The lightning speed execution of crypto AI Agents ensures no lucrative opportunity is missed by the users.

-

24/7 Trading

Unlike humans, crypto AI Agents never take rest and can work round the clock. It continuously keeps an eye on the market and takes necessary action when required. Crypto AI Agents work to make you rich while you are sleeping. In one of the most volatile markets of the world, Crypto AI Agents work all the time and exploit every possible regarding opportunity that comes in the way.

-

Predictive Analysis

Since crypto AI Agents are highly advanced softwares, they can easily predict pricing movements. Based on the predictions they can adjust the pricing strategy on their own and help you grab the best opportunities. These autonomous softwares analyze large volumes of data not just from blockchain but also from social media platforms and make data-driven decisions. This often helps them to integrate with DeFi platforms to manage portfolios without human intervention.

-

Automated Transactions

Crypto AI Agents can make the blockchain transactions independently as per the market movements. They can select the most revenue-generating assets and can manage portfolios with zero human intervention. They are like your personal virtual financial advisor that can handle millions of transactions parallely. By using machine learning and natural language processing technologies, these softwares can execute transactions like buying, selling and even managing assets in DeFi.

-

Real-time Monitoring

The crypto market keeps fluctuating and AI Agents help you to keep up with the changing trends. These self-operating software can analyze large chunks of data in no time, ensuring you miss no opportunity to make more money. Moreover, they continuously scan blockchain transactions to detect suspicious patterns of fishing scams or hacking attempts.

-

Enhanced Security

AI Agents can detect any suspicious or add activity on your crypto account and protect it from scammers. It comes with high security features, which ensures you can make money without worrying about fraudsters.

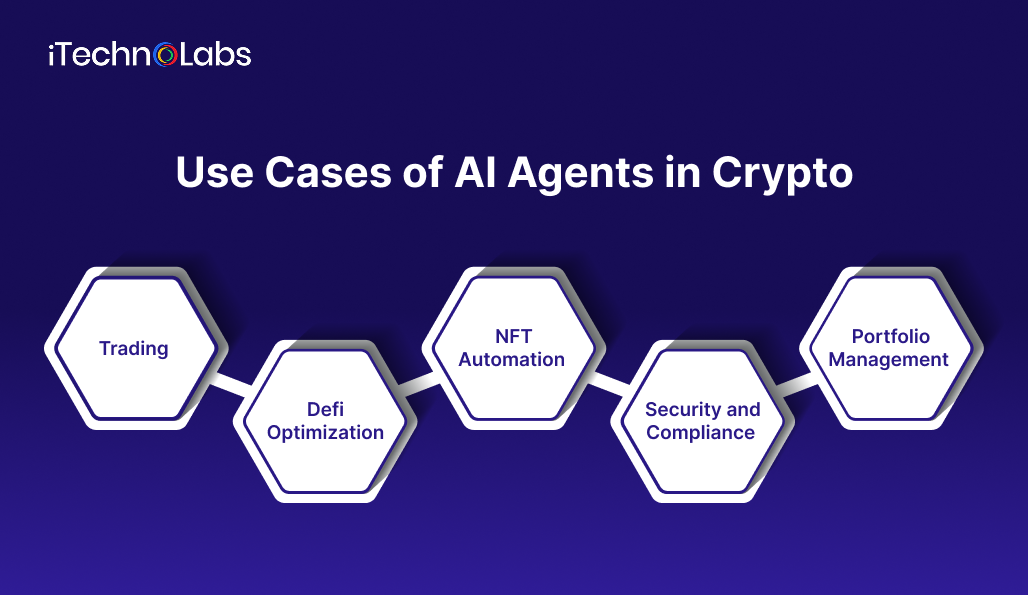

Use Cases of AI Agents in Crypto

People think they can only do trading with crypto AI Agents however its scope is much wider. These agents offer customized insights and let users create interactive NFTs. Also, they provide enhanced security by detecting suspicious activity and prevent users from scams. Further, they rebalance the portfolio for maximum gains and simplify complex DeFi operations. Here are some more use cases of AI Agents in crypto market:

1. Trading

One of the basic uses of crypto AI Agents is trading. These powerful software can analyze large volumes of data, predict the price changes, and can execute the transactions with zero human intervention.

AI Agents work through the day, keep an eye on changing trends and allow traders to exploit every money-making opportunity coming in their way.

2. Defi Optimization

Apart from just trading, crypto AI Agents also rebalances the portfolio, mitigates risk, and provides in-depth analytics to users.

AI Agents make complex Decentralised Finance AI (Defi) transactions more accessible and profitable for both beginners and experienced traders.

3. NFT Automation

Just like cryptocurrencies, AI Agents can also manage and trade non-fungible tokens (NFT). AI Agents can detect any plagiarism in the artwork.

Crypto AI Agents can find undervalued NFTs and forecast future demand. AI Agents in crypto can generate NFTs that can evolve according to the interactions of humans with them.

4. Security and Compliance

The crypto market is full of risks. AI Agents in Crypto can detect any suspicious activity and prevent the trader from financial loss.

Many agents even use anti-money laundering (AML) checks which block the transactions that fail to comply with basic rules.

5. Portfolio Management

AI Agents in crypto can allocate the assets on their own to yield the best returns. Also they can execute trades while interacting with DeFi protocols without human input.

Moreover, by making predictions about future price movements, AI Agents can buy or sell specific assets to generate maximum profit.

Suggested Articles: Guide to Hiring a Great AI Engineer

Major Trends Shaping AI Agents in Crypto

AI Agents in crypto are evolving at an ultra-fast speed due to technological advancements and market demand. These agents are redefining how digital assets are managed. Following are some trends shaping the future of the crypto ecosystem:

-

Amalgamation of AI and DeFi

DeFAI is integrating AI into DeFi platforms and automating tasks like swapping, staking, and auto-compounding. DeFAI Agents can help both new and seasoned investors to execute complex DeFi operations. AI Agents in DeFi make decentralized finance more accessible to all types of investors.

Example – Fetch.ai is a platform that creates autonomous AI tools to execute smart DeFi transactions.

-

Tokenization of AI Agents

Virtual protocol is one of the platforms allowing users to create and co-own crypto AI Agents as digital assets. This approach lets people get ownership and revenue sharing from these agents, opening new collaboration opportunities in the AI crypto ecosystem.

Tokenized AI Agents are changing the way people interact with AI Agents by letting them benefit from the success and performance of agents.

-

Enhanced Security

Since the AI Agents in crypto are highly advanced, they can detect fraudulent and suspicious activities and safeguard users from substantial financial loss.

Example – Griffin AI’s price analyst, launched in January 2025 gives real-time insights on over 2000 cryptocurrencies. It deploys advanced machine learning capabilities to analyze large chunks of blockchain data. This AI agent prevents the user from any kind of scam by consistently monitoring market trends and helping them make smart decisions.

-

Autonomous Business Projects, Mindshare and Sentiment Analysis

AI Agents can execute crypto transactions at a high-speed by monitoring market trends, while also reducing human input to minimal levels. For instance, Kaito AI uses LLM models to analyse vast amounts of data from different sources and provide live insights.

Further, mind sharing and sentiment analysis is becoming an essential part of crypto trading. By utilising sentiments from social media platforms like Reddit and X, independent trading AI Agents can predict market movements accurately and convert data into useful insights in real-time.

-

Multi-Chain Portfolio Aggregation And Integration With Traditional Finance

Crypto AI Agents solve one of the biggest challenges in DeFi – managing assets across multiple chains. It provides a consolidated dashboard which combines holdings from chains like Bitcoin, Etherium, Solana, and more. It simplifies portfolio management by providing real time insights across different asset classes.

Another trend that is coming up is integration of AI Agents in crypto with traditional finance. For example, Blackrock’s Aladdin is a popular investment management platform that has teamed up with coinbase and provides institutions the access to crypto trading.

Challenges and Risks of AI Agents in Crypto

Just like every technology, AI Agents in crypto also come with its own sets of challenges and risks. The AI Agents are still evolving and learning about the crypto marketplace. There is a long journey that AI Agents have to cover and till then there are many issues that will remain there. Here are some of the most common problems with crypto AI Agents:

1. Data Quality

The prediction of AI Agents will be only as accurate as the data we provide it to analyze. In the crypto market one has to deal with unstructured data. For AI Agents to make accurate decisions it’s important to feed relevant data.

If the data is wrong or outdated the AI Agents may not provide the desired insights. The first step of getting accurate predictions from crypto AI Agents is collecting high-quality and well-structured data.

2. Compatibility Issue

Integrating AI into a crypto business is not always as easy as installing an app. In the initial stages you are likely to face some compatibility issues in the existing system.

Your system might not be compatible to work with AI tools and finding a way to make them both work together may take too much time and effort. You may have to do some adjustments in your previous system so that AI could function properly.

3. Security and Privacy

Cryptocurrents hold a lot of sensitive data of users, which is a common concern of many. The AI systems may become the target of cyberattacks resulting in the loss of personal data.

It’s necessary for you to ensure your AI Agents store data according to privacy regulations. To maintain user trust and safeguard the platform, it’s important to balance AI security with privacy protection.

The Future of AI Agents in Crypto

AI Agents are revolutionizing crypto trading forever through real-time insights, independent decision-making ability and predicting future pricing movements. Its ability to churn out real-time insights and detect fraudulent activities make it a reliable partner for any crypto trader. That being said, the future of AI Agents is as bright as one can imagine. Given below are some advancements one can experience in crypto AI Agents in future:

1. Growing Role in Automated Trading

AI Agents in crypto are transforming the future of automated trading. Unlike human traders, these systems can scan market patterns in real-time and execute trades within seconds. This capacity to react instantly reduces the chances of missed opportunities.

Moreover, as machine learning algorithms evolve, AI Agents will become more accurate in predicting price shifts. Traders can expect systems that not only follow pre-set rules but also adapt dynamically to new conditions. In future, automated trading through AI Agents will likely dominate the crypto market, ensuring higher efficiency and reducing human emotional biases.

2. Integration with Decentralized Finance (DeFi)

The future of crypto AI Agents lies strongly in their collaboration with DeFi ecosystems. By combining AI with decentralized finance protocols, users will access smarter and safer investment opportunities. Tasks such as staking, yield farming, and liquidity management will be executed autonomously by AI Agents. This removes technical barriers for beginners while enhancing profits for experienced investors.

Additionally, multi-chain compatibility will allow agents to manage assets across multiple blockchains from a single dashboard. This seamless integration will empower traders to explore cross-chain opportunities easily. Thus, AI-driven DeFi will reshape financial management by increasing accessibility and simplifying complex processes.

Also, read: AI Agent in Customer Service

Conclusion

AI Agents in crypto are transforming the way traders and investors interact with digital assets. From predictive analytics and automated trading to advanced security and DeFi optimization, these autonomous systems enhance efficiency and profitability in the volatile crypto landscape. As adoption grows, traders who leverage AI Agents will gain a competitive advantage in managing portfolios and identifying market opportunities. For businesses and individuals seeking best AI Agents in crypto, iTechnolabs offers expert development services to build secure, scalable, and performance-driven AI-powered platforms. Explore iTechnolabs AI agent development services to stay ahead in the evolving crypto economy.

FAQs

1. What are AI Agents in crypto?

AI Agents are independent software programs that trade, monitor, and manage crypto assets with minimal human intervention.

2. How do AI Agents differ from chatbots?

Chatbots guide users, while AI Agents execute transactions and take decisions independently.

3. Can AI Agents work 24/7?

Yes, they operate continuously without rest, monitoring markets in real time.

4. Can AI Agents manage NFTs?

Yes, they can trade, analyze, and detect plagiarism in NFTs.

5. Where can I get a custom crypto AI agent?

You can connect with iTechnolabs for tailored AI agent development.