AI has already started transforming how every industry in the world works. Banking is no different. Many banks around the world understand the importance of using AI in banking. Whether it’s a chatbot or an agent, the banks have started implementing AI in their daily operations. AI in banking offers many benefits. These include improved customer service, greater efficiency, and better risk management. It also helps with regulatory compliance, saves time, cuts costs, and reduces errors. AI agents in banking automate time-consuming tasks of leaders and make them free to make strategies for the future. Agentic AI in banking stops fraud by spotting suspicious activities right away. It also helps the team act quickly. Read this blog to learn more about AI in banking, its advantages, use cases, challenges, and more.

Advantages of Agentic AI in Banking

Agentic AI offers many benefits in banking. It boosts efficiency and lowers costs. It also enables data-driven decisions, improves security, and enhances risk management. Listed below are some of the benefits of implementing AI agents in the banking system:

1. Enhanced Customer Service

AI agents give personalized product recommendations based on your transaction history and preferences. Moreover, AI-powered chatbots provide instant answers to customers’ queries. All these things improve the experience of banking customers and make them come back.

2. Increased Efficiency

Gone are the days when employees have to do everything on their own. Today, AI agents in banking can automate time-consuming tasks of people in the organization and make them free to do value-driven work. It can take care of all routine work, such as entering the data, processing the documents, and onboarding customers.

3. Better Risk Management

AI agents in banking can analyze huge amounts of data in seconds. This helps banks spot anomalies and prevent fraud. With their advanced capabilities, AI tools can detect any suspicious activity in real-time and inform the team. This helps them take necessary action before the situation escalates.

4. Regulatory Compliance

The biggest issue for any bank is to keep complying with the new regulations coming into effect daily. Here, agentic AI in banking comes to the rescue. AI agents help banks to comply with all the regulations without fail. The AI-powered tools can consistently monitor global regulatory websites in real-time. After that, it informs the legal team accordingly for timely implementation.

5. Cost-Saving

AI agents in banking cut costs by automating tasks. They handle customer queries, loan processing, and fraud detection. This minimizes reliance on large support teams, cutting labor expenses while improving efficiency. By streamlining workflows and reducing manual errors, banks save both time and resources. AI agents provide 24/7 service without extra costs. This saves money and keeps customer experiences and operations top-notch.

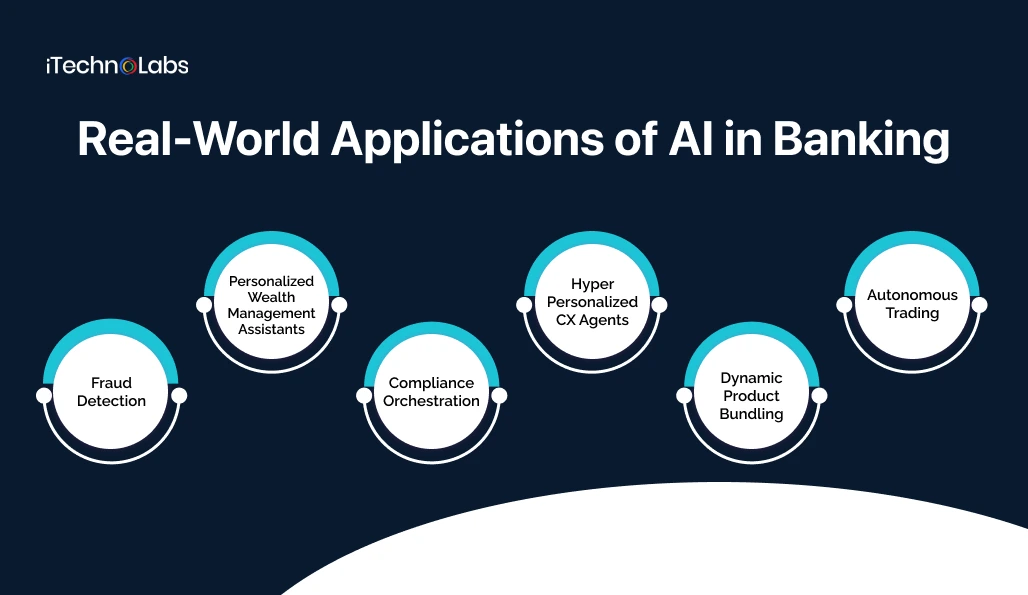

Real-World Applications of AI in Banking

Organizations worldwide use AI in banking for many reasons. It detects fraud, offers personalized wealth management, evaluates credit, and connects with customers. Here are some of the use cases of AI in banking:

1. Fraud Detection

Scammers are evolving every single day and learning new tactics to manipulate the banking data. The traditional systems are not capable of detecting these frauds with speed and accuracy. Here come AI tools, which can prevent fraud in seconds as compared to the hours it used to take by human analysts earlier. AI in banking can highlight the anomalies and suspicious activities that actually matter.

Example – Many banks in 2025 still run on old systems that alarm the employees even if a minor rule is broken. Here, HSBC took a different route with Google by building a dynamic risk assessment platform. Rather than fixing on strict thresholds, the system transactions live, reducing the number of false alarms.

2. Personalized Wealth Management Assistants

Wealth management is a core service of any bank. But the problem is that even the best human advisors can’t predict the market. On the other hand, AI tools with their advanced capabilities can bridge this gap. It can tailor the portfolio according to the unique goals of every customer and can adjust it based on the market.

Example – Citibank is planning to launch AI tools that go beyond the traditional dashboards and static reports. The platform blends a conversational AI assistant with trading features. This way, advisors receive raw data and can ask questions for tailored answers.

3. Compliance Orchestration

One of the biggest challenges for a bank is to cope with the changing regulations. Updating the system manually leaves room for errors and risks. AI compliance agents change the game. They watch for regulatory updates and make instant adjustments.

Example – Kodex AI operates various specialized AI regulatory updates. This helps financial institutions stay abreast of ever-changing compliance demands. One of the agents monitors regulatory bodies worldwide and builds a list of regulatory changes. Another agent converts the raw data into executive summaries. Together, these agents save hours for teams reading regulatory journals. This enables faster policy implementation.

4. Hyper Personalized CX Agents

Everyone today needs personalized attention, and banking customers are no different. AI agents in banking, such as CX agents. They learn from past interactions, understand customer needs, whether it is through a mobile app, a call, or a website. Through this, the customer receives proactive insights, and their relationship with the bank gets deeper.

Example – BBVA has integrated AI into its financial health tools to recommend personalized savings to customers, ultimately improving customer engagement. It’s also one of the quickly growing agentic AI that is used in banking.

5. Dynamic Product Bundling

A common challenge many banks face is aligning product pricing with customer needs and market patterns. AI agents in banking solve this problem by understanding individual journeys, pricing of competitors, and outside signals. They can easily bundle loans, cards, and other products that best match customer requirements.

Example – One of the largest banks in Brazil, Bradesco, used agentic AI to fix one of its oldest problems: slow and inconsistent pricing. Earlier, bundling products used to take weeks, but now with Agentic AI in banking, Bradesco has cut the time by 22% and achieved pricing accuracy by 17%.

6. Autonomous Trading

Markets move in the blink of an eye, and even the best trading desks can’t keep pace with every micro shift. Autonomous AI agents in banking, with their advanced capabilities, can adjust the portfolio in real-time. The result is an AI-managed portfolio without constant manual intervention.

Example – Wealthfront’s suite of automation clearly shows how agentic AI in banking shapes portfolio management. They not only rebalance the portfolio but also check the market daily to exploit the best money-making opportunities. If an investment is falling, it analyzes whether selling it or replacing it with a high-value alternative would make sense.

How Agentic AI in Banking Drives Growth

After understanding the benefits and use cases, it’s important to understand how AI agents in banking actually help in growing. The following are some pointers to understand how agentic AI in banking drives growth:

-

Cost Saving

Agentic AI in banking plays a crucial role in driving growth by significantly reducing operational costs. By automating repetitive tasks such as customer onboarding, compliance checks, fraud detection, and transaction monitoring, banks can cut down on labor-intensive processes and minimize errors. AI-driven chatbots and virtual assistants also reduce call center expenses by efficiently handling routine customer queries. Additionally, predictive analytics helps optimize resource allocation, streamline back-office operations, and prevent financial losses. These cost savings not only improve efficiency but also allow banks to reinvest in innovation, enhance customer experiences, and create sustainable growth in a highly competitive industry.

-

Fewer Fraud Losses

Frauds are still the biggest challenges for any bank in today’s time. The problem is that static models are outdated and can’t keep up with fast-changing schemes. Self learning agentic AI in banking quickly learns patterns across huge amounts of data and detects any new threat the moment it appears. HSBC has reported a 50% decrease in false positives after deploying anomaly-detection agents by Google Cloud.

-

Compliance with Regulations

Banks cannot avoid compliance costs, and the human labor around it slows banks down. Agentic AI in banking consistently monitors the regular updates. Rather than waiting for the audit session, compliance is implemented in daily operations. Capgemini estimates that using agentic AI can cut down audit preparation time by half. For large banks, this not only means avoiding penalties but making teams free to focus on high-value tasks.

-

Better Lifetime Value

Better Lifetime Value (LTV) in banking is achieved when customers stay longer, engage more, and use multiple services. Agentic AI enhances this by providing hyper-personalized recommendations, predicting customer needs, and delivering timely financial advice. For example, it can suggest suitable investment options, credit upgrades, or savings plans based on real-time behavior. This not only builds stronger trust but also increases product adoption. By proactively resolving issues and creating a seamless experience across channels, banks improve customer satisfaction and loyalty. As a result, Agentic AI maximizes the overall value each customer brings throughout their relationship with the bank.

-

Speedy Decision and Service

Earlier, loan approval used to take a few days, sometimes weeks. With agentic AI in banking, the same process can be done within minutes. The AI agents in banking don’t just check boxes, but also check structures and unstructured data simultaneously. For example, Upstart’s AI-powered model proves that smarter underwriting can open doors to a larger number of borrowers. The tool has delivered an approval rate of more than 40%, which is higher than many legacy lenders. Additionally, it took manual work out of the process.

Also, read: AI Voice Agents: Create Smart Assistants with AI Voice Generators

Key Features of Agentic AI System

Here are some key features of agentic AI in banking:

1. Core Architectural Features

An AI agent in banking is not an ordinary machine learning model. It’s a framework where decisions are tied to business goals, tested before executing, and refined through feedback.

- Goal-driven models – AI agents in banking must be aligned with the objectives of the organization, approving loans, supervising liquidity, detecting fraud, but within thresholds set by risk teams. The guardrails prevent autonomy from becoming uncertain.

- Simulate before action – No bank should give that much power to an agent to act blindly. Running the tool in a safe environment ensures that results are understood before changes are made to live systems.

2. Security and Compliance Layers

One of the most regulated sectors in the world is banking. This clearly means that every decision taken by an AI agent in banking has to be accountable, explainable, and auditable.

- Encryption and access control: Every data moving in and out of AI agents must be locked down, along with the permissions that define who can review decisions.

- Auditability by default: Banks need to keep this thing in mind that regulators don’t accept black box answers. Every transaction that was blocked and a credit transaction that was declined needs to have a justification.

3. Seamless Integration with Traditional Banking Systems

No large bank is going to start from scratch. The AI model must be able to integrate with the existing systems of the bank. Therefore, a legacy application modernization strategy is crucial for perfect adoption.

- APIs for connectivity: Open APIs let agents plug into core banking systems, payment networks, and risk management tools, without scattering everything apart.

- Cloud native where possible: Elastic cloud-based deployment provides the bank the capability to manage the spike in the volume of transactions without having to compromise on performance.

Challenges of AI in Banking

AI, at the end, is a technology, and just like any other, it also has its own challenges to implement in banking. Only after understanding these challenges and resolving them can a bank be able to use it. Here are some of the biggest challenges for using AI in banking:

1. Regulatory Concerns

One of the largest challenges for any bank to implement AI in banking is to comply with regulations. Many of today’s frameworks are not designed for self-independent systems’ main real financial decisions. This leads to two problems:

- AI explainability: Supervisors don’t sign off on a loan decision just because a model said so. Basel IV, MiFiD II, and GDPR all require a proper audit trail. If an AI agent in banking can’t explain itself, the bank is at risk.

- Accountability: Who will be responsible if AI takes a misstep? The technology, the IT, or the board. Till the time accountability framework goals are clearer, the legal department will keep resisting adopting AI.

2. Data Quality

Agentic AI in banking will produce results based on the quality of data it is trained on. The problem is, for most banks, the data is scattered. The customer information resides are multiple places, such as onboarding, risk, and CRM, making it difficult to form a complete picture.

In the real world, this means incomplete data sets, higher chances of bias, and less accuracy. Even if the data is put together anyhow, mixing structured records with unstructured inputs remains a messy and expensive process.

3. Talent Shortages

Globally, there is no shortage of AI engineers, but finding one who understands banking is a completely different thing. For banks, knowing how to hire an AI developer with both technical expertise and domain knowledge is crucial.

Reinforcement learning experts rarely know the Basel rules, while compliance professionals rarely know anything about model training. Bridging the gap between the two requires a hybrid skillset.

4. Cultural Resistance

Even if the banks have a solid model and it even performs well, there is no use if the employees don’t want to use it. This is not as easy as it sounds.

Loan officers may sideline the AI agent in banking when decisions come from a machine. Compliance teams may fear losing control. The field person may not trust something they can’t see or explain to customers.

Moving from a rule-based system to a self-independent system is not just a technology shift but also a cultural shift.

Suggested article: AI in the Workplace: Driving Innovation and Efficiency in 2025

Conclusion

AI in banking is not optional but a necessity. The banks that will use it will get ahead; the rest will regret it later on. The agentic AI in banking is the most advanced self-independent software that can do every routine task and make leaders free to plan for the future. Some notable benefits of AI agents in banking are enhanced customer service, improved efficiency, better productivity, improved security, and more. The real-world use cases of AI are Personalized Wealth Management Assistants, Compliance Orchestration, Dynamic Product Bundling, Autonomous Trading, and Fraud Detection.

However, along with the benefits and its amazing features, the agentic AI in banking comes with its own set of challenges. If you have a bank, you don’t need to deal with these challenges alone, which will eat up your time and money. At iTechnolabs, we help you implement every type of AI in your business, whether it’s an agent, chatbot, or any other model. Visit the website, discuss your requirements, and choose from over 200+ AI experts and take your bank to the next level.

FAQs

1. What is agentic AI in banking?

Agentic AI in banking refers to autonomous AI-powered assistants that provide a wide range of benefits to banks, such as enhanced fraud detection, improved customer experience, automated routine tasks, increased productivity, lower operational costs, and better regulatory compliance.

2. How can agentic AI change the way banks fight financial crime?

Autonomous AI agents continuously monitor the market to find any anomalies, suspicious activities, and thus prevent fraud. This allows banks to take necessary action before the situation escalates. The real-time fraud detection capability of AI agents strengthens the financial stability of banks.

3. Which AI is best for banking?

The best AI depends on the unique requirements of the bank. The ideal AI tool for every bank will be different. However, to name a few good AI tools for banking are Meniga, Velmie, Sopra Banking Software (SBS), nCino, CR2, Kasisto, and Infosys Finacle.

4. How much does an AI agent cost?

The cost of an AI agent varies from organization to organization. Some AI tools have fixed pricing, while some come with custom pricing. The cost depends on many factors, like complexity, use case, data requirement, updates, and deployment. However, to give you an idea, the cost of an AI agent may range between $5,000 and $5,00,000.

5. Is Agentic AI safe for handling financial data?

Yes, Agentic AI is designed with strong security measures like encryption, access control, and real-time threat detection. It keeps sensitive financial data safe while processing transactions or customer requests. Still, banks must keep updating security rules and monitor systems closely. With proper compliance, AI agents are quite secure and trustworthy for handling large amounts of financial information.